The majority of AI x Crypto companies are still working on the obvious narratives (decentralized inferences/training/computing). However, I expect that the largest winners will probably build products outside these obvious ideas. One of the ideas I am most interested in is Tokenized Model/Dataset Ownership.The magic of crypto is tokenized ownership. Attracting capital to develop, fine-tune, operate and own an AI model brings crypto to the heart of AI. It’s possible to build decentralized OpenAI with the main difference being that each model is owned by different sets of owners.One of the efforts in this area is @OraProtocol%E2%80%99s Initial Model Offering (IMO)The main challenge with tokenizing an AI model is defending the model's edge from copying/replication and ensuring real value capture. Opensource models, despite the great performance improvements, cannot provide that protection. This challenge can be solved by supporting private/proprietary models on chain.To enable such models, special infrastructure is needed to protect innovative AI models without reintroducing centralized censorship. This infrastructure should allow both decentralized training and inference of the private models without leaking information about the model weights at any step.

Multi-party computing (MPC) and Trusted Execution Environments (TEEs) are good candidates to enable these private tokenized models. MPC can be used to split any model into parts that are collaboratively trained without leaking the full model. MPC can also be used for inference but the computational overhead can be high. Encrypting the full model and performing the inference within a TEE offers a similar outcome while reducing overhead. The inference results can be always verified on-chain via MPC attestations, TEE attestations or ZKPs.

I expect tokenized AI models and applications built on top of them, e.g., on-chain AI agents, to become the de-facto way of bringing AI onchain. If you are building in this sector, my DM's are open

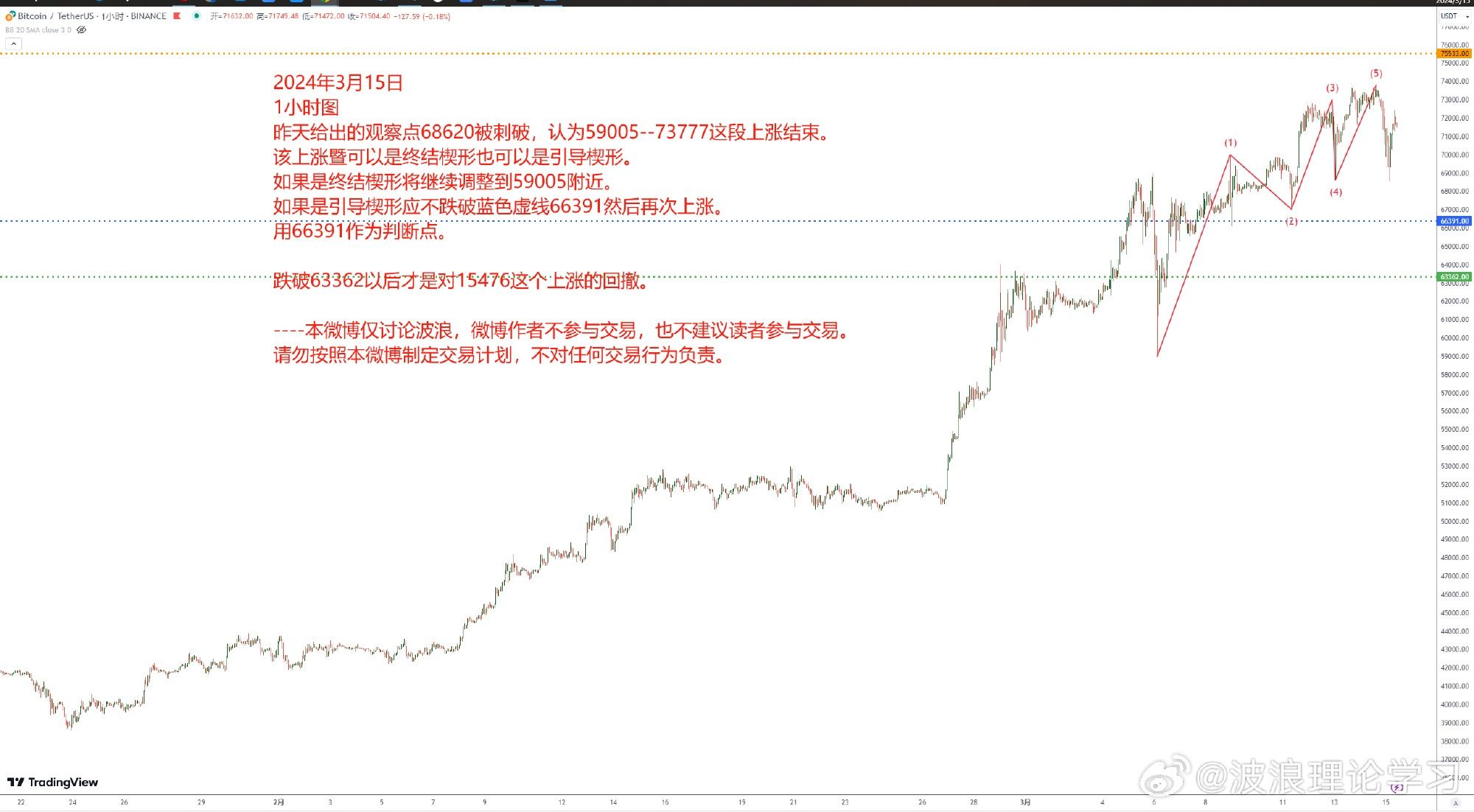

#BTC 59005-73777这段上涨结束。该上涨可能是终结楔形或者引导楔形。如果是终结楔形将继续调整到59005附近;如果是引导楔形泽不能跌破66391,然后继续上涨。用66391作为判断点,跌破63362以后,才是对15476这个上涨的回撤。

#btc 59005-73777 should end the rise. This rise may be a wedge or a leading wedge. If it is a wedge shape, it will continue to adjust to around 59005; if it is a wedge shape, it cannot fall below 66391 and then continue to rise. Taking 66391 as the judgment point, after falling below 63362, it will be a retracement of the rise of 15476.

黄金维持去年12月的看法,目标正在实现中。AI等于蒸汽机的发明,大清不明白蒸汽机后面的东西所以被打败,苹果和特斯拉没有引领AI所以走弱。AI算力将每半年增长10倍,巨大的市场需求有力支撑英伟达。如几年前的10张大饼很容易获得一样,现在获得100股英伟达也很容易。但10年以后10张大饼和100股英伟达都会高不可攀。“100股英伟达可以养老”将会实现。

Gold maintains its December view and targets are being met. AI is equivalent to the invention of the steam engine. The Qing Dynasty did not understand what was behind the steam engine, so it was defeated. Apple and Tesla did not lead AI, so they weakened. AI computing power will increase 10 times every six months, and huge market demand supports Nvidia. Just as it was easy to get 10 pieces of pie a few years ago, it is also easy to get 100 shares of Nvidia now. But in 10 years, 10 pieces of pie and 100 shares of Nvidia will be out of reach. "100 shares of Nvidia can provide for retirement" is about to be realized.

January 19, 2024, daily chart, the gray line is the first part of the decline. The rebound within the orange dashed line channel has ended. Now the gray line continues to extend. Pay attention to the blue dashed line 40400 drawn last week, there is support here that may rebound. If the support is not strong, there is a risk of falling to 36855 if it stays below 40400 for a long time. The above is only a personal analysis record, not as investment advice.

Friends:

The carnage of the past twelve months in crypto has been brutal for all of us. We’ve grinded through bankruptcies, lawsuits, layoffs, turnover, and a general malaise that comes with a bad hangover after a big party.

It’s been surreal at times, too.

In some respects, the industry was blown back to 2013 following its first credit crisis (survivors include decade-long operators like Coinbase, Kraken, and Circle). But we have never been operating further out on the cutting edge of tech than we are today. There’s lots of secure block space and scaled transaction processing, composable identity and DeFi applications, stablecoin proliferation, etc.; and Wall Street’s embrace is imminent, whether Jamie Dimon likes it or not.

I didn’t think Sam Bankman-Fried would be in jail by the time I wrote the 2024 Theses. But his swift comeuppance and lengthy prison sentence marked an important turning point for us all. If last year’s report was “It’s So Over,” this year’s report is “We’re So Back.”

We’re back to bitcoin dominance. Back to building parallel financial systems “just in case” national currencies inflate, or we lose access to banking or credit. Back to peer-to-peer applications and permissionless inventions vs. cultish centralized services. Back to a focus on an uncensorable internet in an era where free speech and open communications are far from guaranteed. (Elon bought us some time, but there are growing threats.)

2

That’s why I remain perma-bullish on this technology and this community.

There is reason for hope and optimism. A big part of succeeding in crypto is simply surviving from cycle to cycle. If you’re reading this, you’re one of the survivors, and I wrote this for you.

The usual disclaimers apply: this report is not investment advice, mistakes are likely in a compendium this long and rapidly written, and (this year, especially) you are prohibited from canceling me for (accurate material) political analysis that may be unpopular.

This is a free report that we’re making available early to subscribers. We’re still emerging from a bear market, so if you get value out of the Theses every year, I hope you’ll support our team: subscribe to Pro or Enterprise, test our API, and consider Protocol Services for your community.

Don’t make me put Barbara on this. Please support the builders at Messari.

Happy holidays! -Ryan Selkis (aka TBI)

0.1 Perspective

This was the industry five years ago. When in doubt, zoom out.

(Source: Messari Screener)

Crypto remains inevitable.

3

TABLE OF CONTENTS

0.1 Perspective 3

1 TOP 10 INVESTMENT TRENDS 7 FOR 2024

1.0 Investment Trends 8

1.1 BTC & Digital Gold 9

1.2 ETH & The World Computer(s) 12

1.3 The (Liquid) Field 13

1.4 The Resurgence of Private Crypto Markets? 16

1.5 IPOs and M&A 19

1.6 Policy Meta 20

1.7 Can Devs Do Something?! 21

1.8 AI & Crypto: Money for the Machines 22

1.9 Three New De’s: DePIN, DeSoc, DeSci 23

1.10 Messari Analyst Picks 25

2 TOP 10 PEOPLE TO WATCH IN 2024 31

2.0 Where Are They Now 32 2.1 Larry Fink (BlackRock) & 32

Cathie Wood (ARK Invest)

2.2 Jeremy Allaire & Dante Disparte (Circle) 33 2.3 Kristin Smith (The Blockchain Association 34

& Michael Carcaise (Fair Shake PAC)

2.4 Senator Elizabeth Warren (and her Minions) 34

2.5 Elon Musk (and his Stans) 2.6 Michael Sonnenshein &

Craig Salm (Grayscale) 2.7 Nic Carter & Matt Walsh (Castle Island Ventures)

2.8 Lucas Vogelsang (Centrifuge), Denelle Dixon (Stellar) & Christine Moy (Apollo)

3 TOP 10 PRODUCTS OF 2024 43

3.0 Killer Apps 44 3.1 USDT on Tron 46 3.2 BASE from Coinbase 47 3.3 Celestia 48 3.4 Firedancer 49 3.5 Farcaster 50 3.6 GBTC 51 3.7 Lido 52 3.8 CCIP 53 3.9 Blur, Blend, Blast 54 3.10 Project Guardian 55

4 TOP 10 CRYPTO MONIES OF 2024 57

4.0 Bitcoin & Other Digital Monies 58 4.1 Bitcoin is the Godzilla of Finance 58 4.2 Bitcoin Security Model & Assumption 61 4.3 Bitcoin Mining More Important 63

Than Ever

4.4 Private Transactions: Protocols, 63

Coins, or Pools?

4.5 The New TINA Trade: Stablecoins 66

2.9 Dan Romero (Farcaster) & 41 0x Racer (friend.tech)

2.10 The DeFi Gang(s) 41

37

38 4.6 USDT 67

4.7 USDC 68

39 4.8 Paxos, Binance & PayPal Dollars: 69 4.9 Crypto-Collateralized Stablecoins 70

40 4.10 CBDCs & Other Memecoins 71

4

5 TOP 10 CRYPTO POLICY TRENDS 74 FOR 2024

5.0 Trigger Warning 75

5.1 Politics is Downstream of Culture 76

5.2 How a Crypto Bill Becomes a Law 79

5.3 Congressional Sausage Making 81

5.4 The Relentless Hostility of 85

the Money Regulators

5.5 The Relentless Hostility of the Protectooors 88

5.6 The Courts Are Our Friends... Sometimes 91

5.7 Swinging the Senate 92

5.8 Stand with Crypto: Engagement 94

vs. Kowtowing

5.9 We Need to Set Higher Standards 95

5.10 MiCA & TFR: Europe’s “Leadership” 98

6 TOP 10 TRENDS IN CeFi 101

6.0 State of CeFi 102

6.1 What. A. Year. For. Coinbase. 103

6.2 Binance in (‘2)4 104

6.3 The “Other” Net CeFi Winners 106

6.4 The ETF Race(s) 108

6.5 DCG and the Fall of Rome? 109

6.6 Banking Choke Points 113

6.7 CME vs. Perps vs. dYdX 114

6.8 Compliance Tools - Tax and 115

AML Forensics

6.9 Compliance Tools - Diligence 116

6.10 Everyone Else in TradFi 118

7 TOP 10 TRENDS IN 119 LAYER-1 NETWORKS

7.0 Networks & Interoperability 120

7.1 Ethereal Network Dominance 121

7.2 Value Accrual and Security in 122

a Multichain World

7.3 Network Decentralization 123

7.4 The Evolution of Censorship Concerns 125

7.5 The Bull Case for Ethereum 126

7.6 Dank Rollups 128

7.7 The Modular Moment 130

7.8 Solana’s Resurgence + MOVE It or Lose It 132

7.9 FHE and ZK Trends 134

7.10 The Evolution of Bank Chains 136

8 TOP 10 TRENDS IN DeFi 138

8.0 DeFi is Back? 139 8.1 DEX Platform Updates 139 8.2 Trading Aggregators & Front-Ends 141 8.3 Payments! 143 8.4 On-Chain Perps 144 8.5 DeFi Lending 146 8.6 LSTs 148 8.7 Bridges & Messengers 151 8.8 Oracles 152 8.9 RWA Diversification 154 8.10 Stacks & BRC-20s 155

9 TOP 10 TRENDS IN 157 CONSUMER CRYPTO

9.0 Consumer Crypto 158 9.1 DeSoc 159 9.2 friend.tech 161 9.3 NFT Market Models 163 9.4 The March of the Penguins 164

& Ordinal Theory

9.5 Crypto Gaming & Digital Native Brands 166 9.6 Token Bound Bound Accounts 167 9.7 Co-Creation & UGX 168 9.8 Bet-To-Play Gaming & Information Markets 170 9.9 Network States 171 9.10 Techno Optimism 172

10 TOP 10 TRENDS IN 174 PEER-TO-PEER INFRASTRUCTURE

10.0 Crypto Usability Upgrades 173 10.1 Wallet-Centric Future: MPC Upgrades 175 10.2 Wallet-Centric Future: Smart 176

Contract Accounts

10.3 Wallet-Centric Future: Embedded 178

“Wallets-as-a-Service” vs. SuperApps

10.4 The Ledger Recover Debacle 180 10.5 DePIN Storage Wars 181 10.6 Decentralized Databases 183 10.7 Decentralized Wireless Networks 184 10.8 DePIN’s AI Machines 185 10.9 Select DAO Dysfunction 187 10.10 DAOs Are Worth the Headache 188

11 BONUS: RE-READ 190

11.1 Why You Must Write 191

11.2 No Idols 191

11.3 Must Read 191

11.4 Tips & Productivity Tricks 192

11.5 Life Advice 193

11.6 End (Disclaimers) 193

5

messari.io

6

CHAPTER 1

TOP 10 INVESTMENT TRENDS FOR 2024

1.0 Investment Trends 8

1.1 BTC & Digital Gold 9

1.2 ETH & The World Computer(s) 12

1.3 The (Liquid) Field 13

1.4 The Resurgence of Private Crypto Markets? 16

1.5 IPOs and M&A 19

1.6 Policy Meta 20

1.7 Can Devs Do Something?! 21

1.8 AI & Crypto: Money for the Machines 22

1.9 Three New De’s: DePIN, DeSoc, DeSci 23

1.10 Messari Analyst Picks 25

7

1.0 Investment Trends

Last December, I retired the term “Web3” on behalf of everyone in crypto.

It was a bullshitty, PR-speak moniker that ruined every interesting thing we were trying to build. NFT pfp collections were Web3, “DeFi 2.0” was Web3, Sam Bankman-Fried

was Web3. I wanted more crypto: personal wallets, transaction privacy, infrastructure advancements, DeFi, DePIN, and DeSoc primitives that didn’t rely entirely on ponzinomic schemes. Things like that.

This year did not disappoint.

Since murdering the term Web3 in cold blood, crypto’s market cap has nearly doubled. Our biggest fraudsters are either in jail or heading there soon. Great products with slick designs got shipped. And I’m even more excited about crypto’s prospects in 2024.

In short, the state of crypto is strong.

I recognize there are some newcomers reading this treatise, so I’ll remind you that this

is a 201-level course, not Baby’s First Bitcoin. I encourage you to play catch-up if you

can: Matt Levine’s masterful crypto explainer / takeover of Businessweek. This list of beginners’ resources. The excellent “Foundations of Blockchains” course for the technical. Otherwise, I assume prior knowledge, and if I’m curt, it’s because time is a factor.

这个开头的“投资趋势”部分是为那些想告诉你的朋友你阅读了整个报告的人准备的。我觉得没有必要从去年报告的前三个部分(“加密货币仍然是不可避免的”)的胜利开始,但我们在各个细分市场都有很好的顺风,并且有证据支持最近急需的看涨在黑暗的冬天之后。

我们将从 2024 年比特币的牛市开始。

8

1.1 BTC和数字黄金

“我们现在在哪里?2015 年 1 月。2018 年 12 月。即卖肾买更多的领土。

-我在 2022 年 12 月对比特币的看法。别客气。

虽然很难在短期内预测比特币的交易地点,但目前它在长期尺度上的吸引力几乎是无可争议的。

我们不知道美联储是否会进一步加息或踩刹车,扭转方向,认真开始量化宽松。我们不知道我们是否会面临由商业房地产推动的衰退,或者我们是否会在超现实的后疫情时期的货币和财政鞭打之后成功实现经济“软着陆”。我们不知道股票是会下跌还是下跌,也不知道比特币是否会被证明与科技股或黄金相关。

另一方面,比特币的长期论点是直截了当的。一切都在走向数字化。政府负债累累,挥霍无度,他们将继续印钞票,直到彻底失败。只有 2100 万个比特币可供投资者使用。市场上最强大的模因即将举行四年一度的营销活动,即 2024 年比特币减半。

有时你必须让事情变得简单!

为了保持同比一致,让我们重温一下我去年写的卖肾MVRV图。回想一下,这是将比特币的当前市场价值(MV)(价格总已实现市场价值(RV)(价格**每个单位最后一次上链时的单位=RV)进行比较。

低于 1 的比率是金色的。超过 3 的比率始终标志着周期顶部。比特币在今年上涨 150% 后仍然是一个不错的“买入”吗?金达。

(来源: Coin Metrics)

9

也许我们不再处于深度价值领域,但考虑到现在我们支持的一些机构利好因素(ETF 批准、FASB 会计变更、新的主权买家等),投资者肯定不会对以 1.3 MVRV 的价格购买比特币抱有信心。见第 4.1 章)。

请记住,随着越来越多的比特币不可避免地被锁定在 ETF 产品中,MVRV 比率也会被人为地拉高,因为与纽约证券交易所和纳斯达克磁带相比,新买家不会像链上那样频繁地出现在链上。略高于 1 的 MVRV 正好低于历史中位数。

你知道什么更诱人,假设你对加密货币作为一种资产类别?

比特币往往会引领复苏。我们最近看到了比特币主导地位的多年高点,但仍然没有接近我们在 2017 年和 2021 年牛市开始时达到的高水位。比特币的主导地位从87%下降到2017年的37%。它在盘整阶段回收了 70%,并在 2021 年升至 40,000 美元,然后在泡沫高峰期跌至 38%。我们刚刚点击了 54%。仍有整合空间。

(来源:Trading View)

老实说,很难看到另一场加密货币热潮的催化剂,而这种热潮不会从持续的比特币反弹开始。

DeFi面临持续的监管阻力,这将在短期内抑制增长。NFT 活动大多已经死亡。其他新兴行业(稳定币、游戏、去中心化的社交和基础设施等)更有可能缓慢而稳定地上涨,而不是急剧和突然上涨。

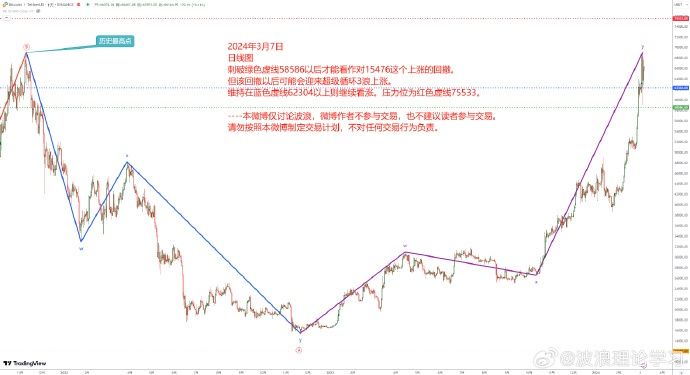

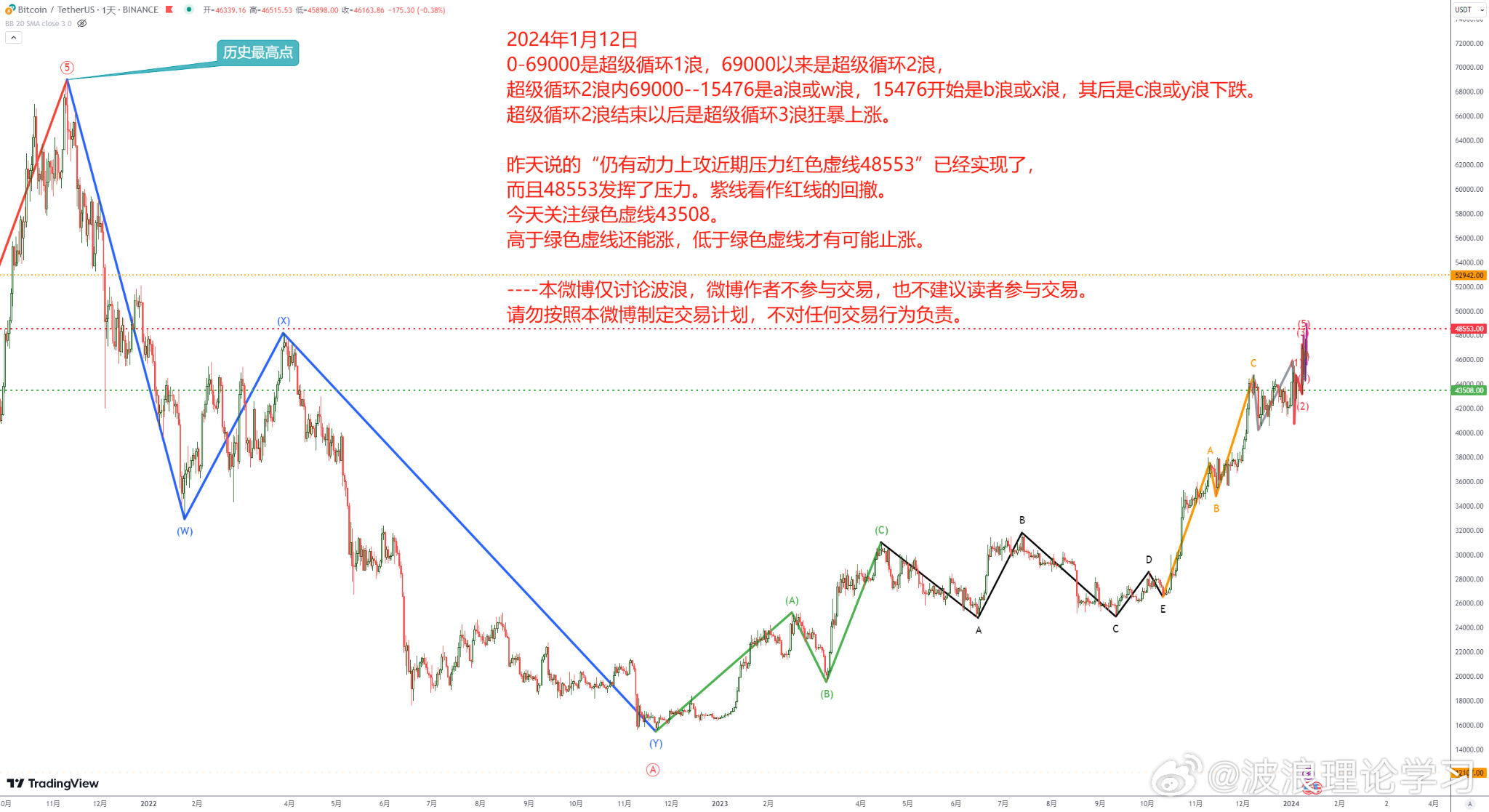

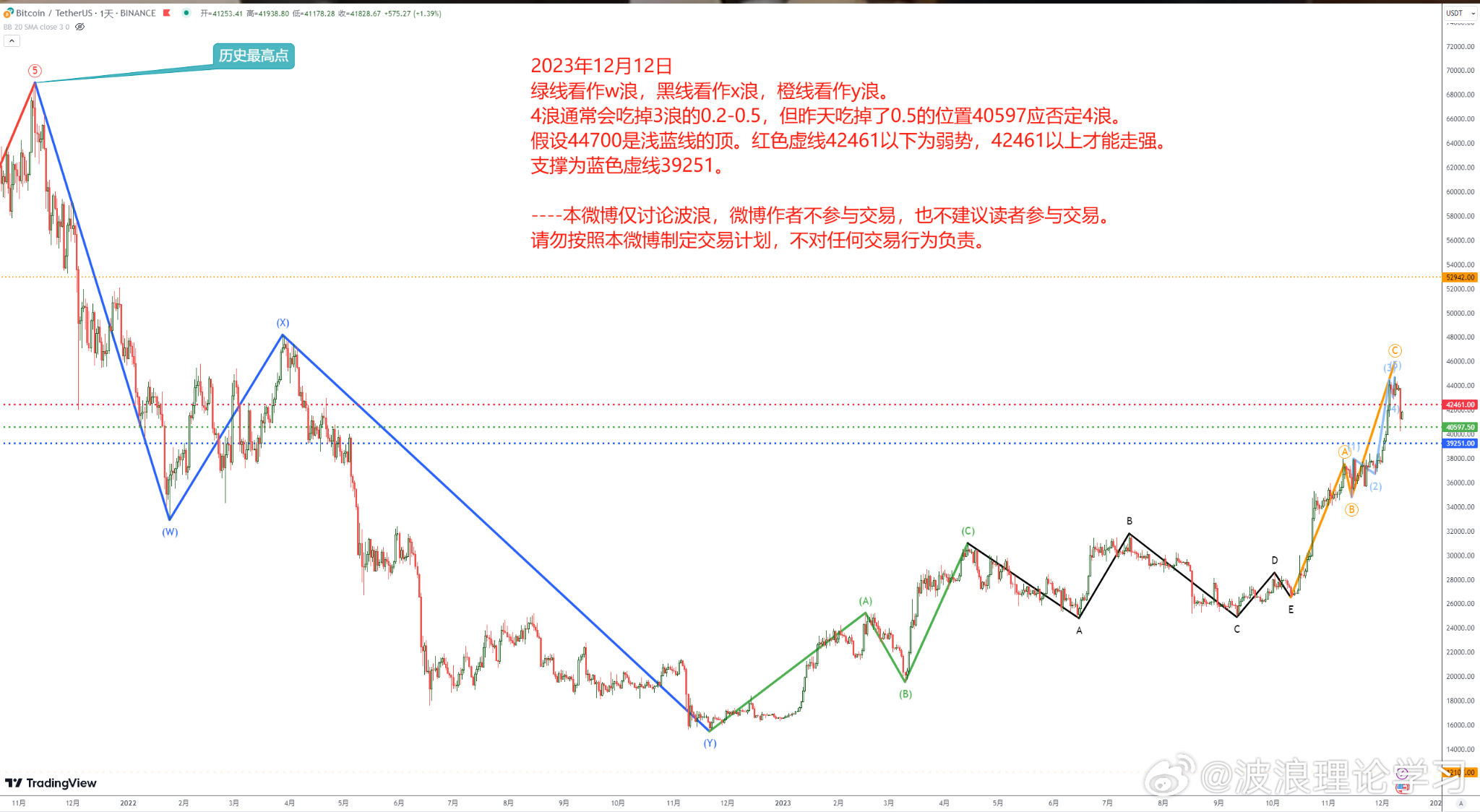

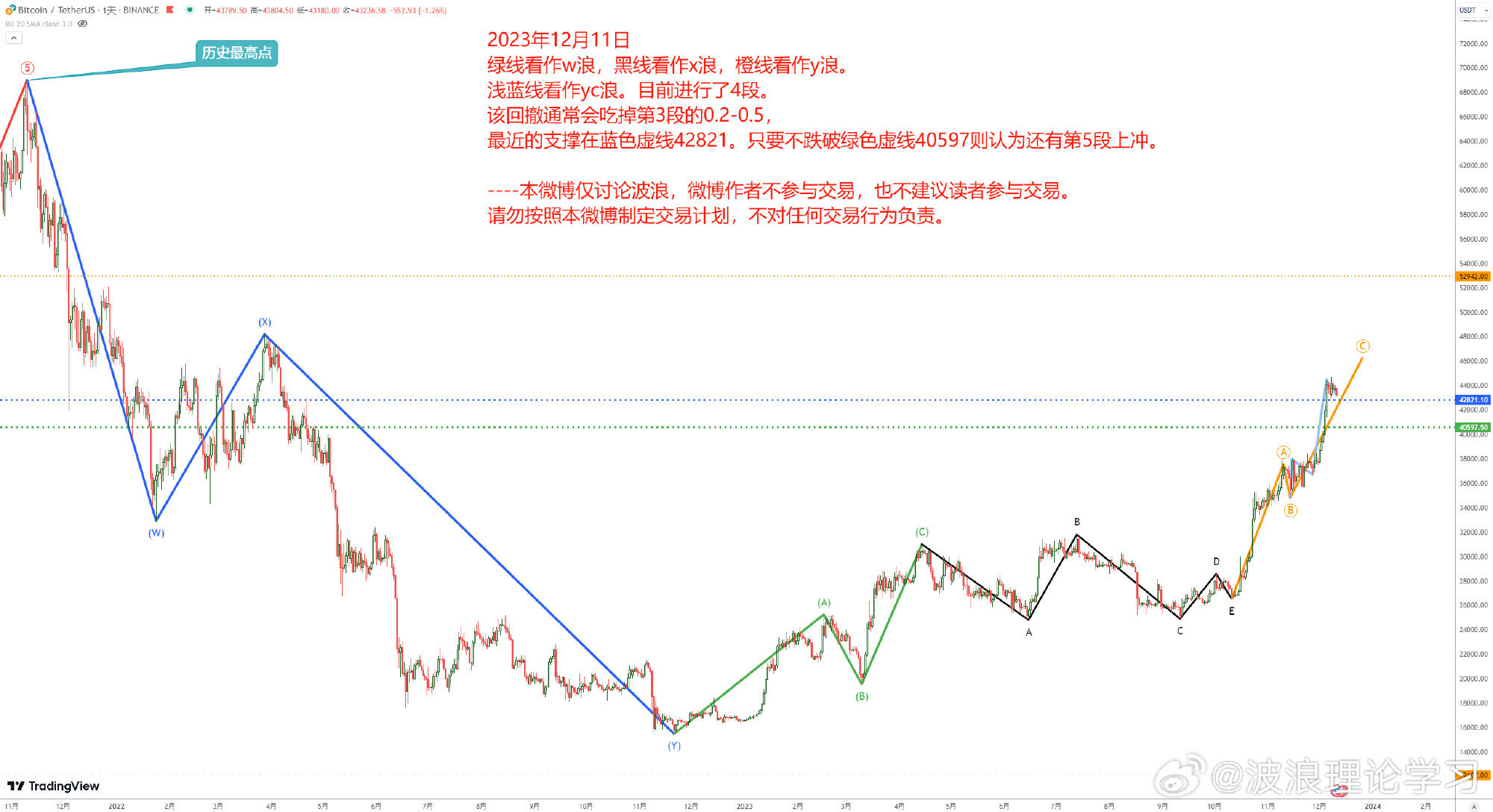

#btc #比特币 比特币自出生以来,0-69000是超级循环1浪,69000以来是超级循环2浪。

超级循环2浪内69000—15476是a浪或w浪,15476开始是b浪或x浪,其后是C浪或y浪下跌。

超级循环2浪结束以后是超级循环3浪狂暴上涨。

今天关注绿色虚线43508,高于它还能涨,低于则可能止涨。

仅讨论波浪理论,不作为投资建议。

比特币自3.48万开始的yc上涨可能已经结束。 若短时间再次新高,则yc浪还未结束。 支撑为39251,跌破则可以确认y结束。 我也不知道咋说了,可能结束,也可能没结束。 没啥有力的证据。调整可能已经调整完了,也可能没有调整完,也没啥有力的证据。 这里很模糊,没有方向的样子。The yc rally of Bitcoin that started from 34.8K may have already ended. If it reaches a new high in a short time, then the yc wave is not over yet. The support is 39251, and breaking below it can confirm the end of y. I don't know what to say, it may be over, or it may not be over. There is no strong evidence. The adjustment may have been completed, or it may not have been completed, and there is no strong evidence either. This is very vague, and there is no direction.

btc 比特币价格已经跌破40497,维持在该价格之上,还有yc5上涨,若维持在40497之下,则yc已经结束,接下来是新一轮下跌。

Trance by chatgpt:The price has broken below 40497, and there is still a chance of yc5 rising if it stays above that level. However, if it stays below 40497, then yc is over and the next round of decline will begin.

I just voted "Yes" on "Poll by @stani.lens%22 snapshot.org/#/polls.lenster.xyz/proposal/0xce612dc6f5060c0d06ab9cc2910eb13fbda337a6a459d885a939ed8c10406a48 #snapshotlabs