The UTXO Realized Cap 6M-12M Dominance has exceeded 20%. This indicates that a large portion of Bitcoin’s realized market cap is held by coins that were last moved 6 to 12 months ago.

…

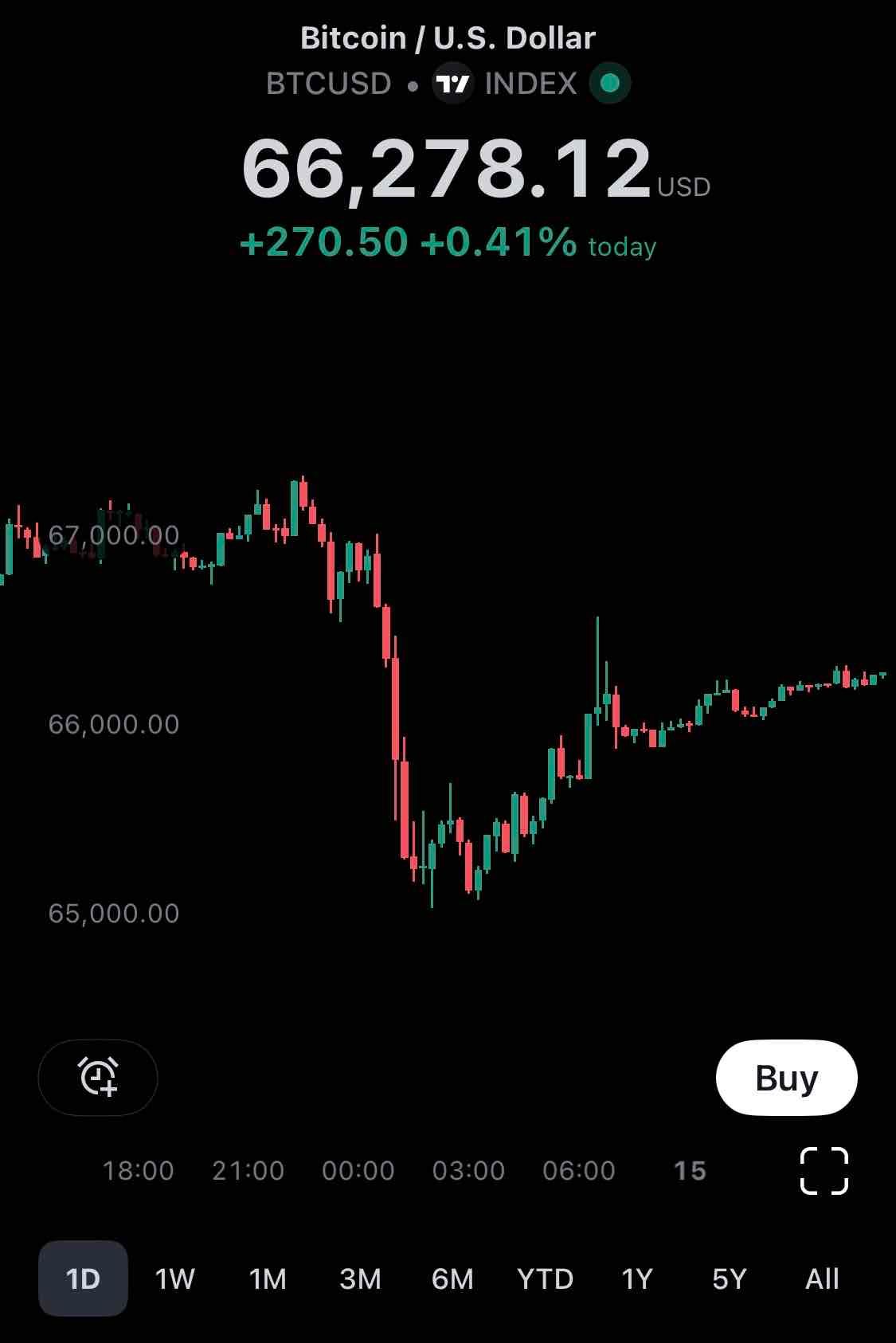

Binance Funding Rates Trending Negative

This chart was originally used to compare Binance Funding Rates (FR) and Bitfinex Reserve during the last bull market. While it hasn’t been as reliable recently, the Binance FR turning negative again prompted me to re-evaluate it.

As of late July 2024, Ethereum’s (ETH) Estimated Leverage Ratio has surged to its current level, indicating a significant increase in leverage in the market. Meanwhile, Open Interest (OI) for Bitcoin (BTC) saw a rise to its current level in mid-March, whereas for ETH, this increase occurred at the beginning of June.

This trend shows that Ethereum has been catching up, reflected in both its rising leverage ratio and the sustained high open interest. This development suggests heightened trading activity and investor interest in ETH, paralleling the trends observed in BTC earlier this year.

Funding rates for OKX, Binance, Bybit, Deribit, HTX, and BitMEX vary significantly, reflecting different trading behaviors. Positive FR means longs pay shorts, indicating a preference for long positions, while negative FR means shorts pay longs, indicating a preference for short positions.

Seeing the funding rates drop again, it looks like we are in a phase of waiting to see when this will end. I expect we will need to watch the market while taking breaks.

Looking at the chart of Bitcoin (BTC) price and estimated leverage ratio, it is clear that recently the price has been stable at high levels, and the leverage ratio is also stable. This suggests that the market is avoiding extreme risks and engaging in balanced trading.

The leverage ratio hovering around the 2020 baseline further confirms the market’s stability. Based on this data, it can be said that the current Bitcoin market is like a calm sea, indicating a tranquil phase.

72MA 72EMA 72WMA Funding Rate:

Since the beginning of 2024, it has surpassed the previous all-time high levels. It has since dropped rapidly and briefly dipped into negative territory. I believe it might start rising again after this adjustment.

chart SIGNAL description:

I've color-coded the 72MA as black, 72EMA as blue, and 72WMA as yellow to track changes in the Funding Rate (FR) and identify potential overbought or oversold conditions. I use these three FR moving averages to predict market trends.

I am currently awaiting an increase in Bitfinex's reserves. During the previous bubble market, when Bitfinex’s reserves were increasing and Binance’s funding rate turned negative, it often indicated that prices were nearing the bottom. While this observation is based on past occurrences, if the user base size of Bitfinex and Binance remains unchanged in this current bubble, I might witness this situation again.

Given the current circumstances where Binance's funding rate has turned negative, I am closely monitoring the developments at Bitfinex.

Since breaking through the $ 50,000 mark in late February (indicated by the circle on the price chart), it is the first time in a long period that the funding rate has turned negative. There is variability among different exchanges (marked by the square area), which began in early April and continues to this day. This shift is speculated to be due to a demand for hedging with physical Bitcoin in anticipation of the halving. Moreover, this hedging demand is likely to be settled through counter-trades, which I believe will help to further drive up the prices in the future.