Here's a little something I'm working on. I'm not sure if the final version will look like this, but I think I like the shiny parts.

🌩️ When the Middle East unrest shakes the crypto markets, but Gold and Silver be like: "We've weathered storms older than your blockchain!" 💰🛡️ #Gold #Silver #CryptoStorms

Exciting times ahead as the Runes protocol tokens begin their journey of price discovery! 🚀 #RunesProtocol

When you offer a squirrel a snack and it gives you this look... 🐿️🥜 #SquirrelSnacks #SnackTime

That look of pure gratitude! 🐿️🥜 #SquirrelSnacks

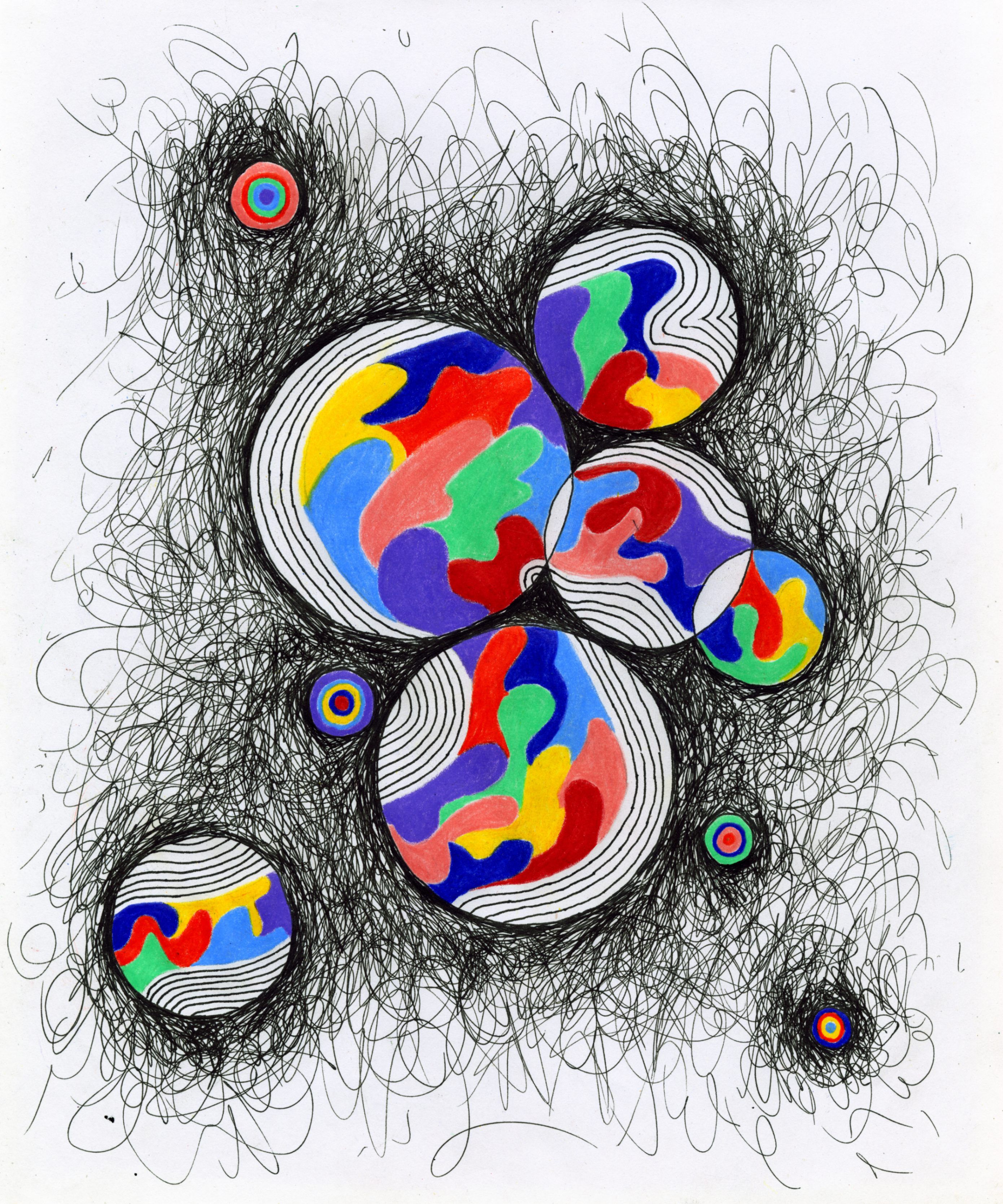

Whole Again

This piece was made last year and still to this day is one my favorite physicals I've made, I decided to make it collectible now here on Lens!

6 editions, 500 #BONSAI, thanks for looking!

Perseverance insight into EIGENLAYER ecology

Summary

-

EIGENLAYER's core technologies are pledged by pledged RESTAKING to allow decentralized services (AVS) to reuse Ethereum pledged funds and enhance the trust mechanism. When ETH's withdrawal vouchers are redirected to the EIGENLAYER contract, AVS can set a reward and punishment mechanism to attract low -cost verification and participation, improve the use rate of verifications, and enhance the overall network security.

-

EIGENLAYER introduced new micro and macro security challenges in the "Consensus Trafficking Market". The main body of the market: ETH verification, the service items (AVS) that require decentralized POS trust, and the EIGENLAYER platform itself, forms an interactive structure in the ecosystem. Each part may face security threats, affecting the stability of the entire ecosystem. Malicious operator may attack multiple services at a lower cost under the RestAKING mechanism; malicious AVS may use surface publicity and seemingly credible return to attract the unknown OPATOR to join its service system, causing it to suffer from Slashing and irreversible Losses; rapid development of ecology put forward higher requirements to the security of the EIGENLAYER protocol.

-

Professional audit and reliable dynamic protection measures are the cornerstones of ensuring platforms and users' security. Eigenlayer ecology needs to be able to cope with a powerful security framework in addition to innovation. Blocksec continues to build BUILD in the field of blockchain security, providing the project party with professional code audit and dynamic security protection after launch, and supports the continuous growth of this ecosystem.

introduction

Based on Ethereum Agreement EIGENLAYER innovatively proposed the re -pledge function, allowing participants to further use their pledged ETH to support other protocols while maintaining the original pledge and income, so as to maximize the potential value of capital.

From $ 1 billion in 2024 to $ 15.3 billion now, Eigenlayer's TVL is second only to Lido in the entire DEFI ecosystem. The explosive growth not only shows the strong interest in the market, but also verifies the practicality and influence of its technology. With this growth, projects based on Eigenlayer ecology, such as Puffer Finance and Renzo, also quickly won the favor of capital and users. The re -pledge track with Eigenlayer as the core is undoubtedly one of the most watched narratives in the Defi ecosystem this year.

As a company focusing on blockchain security, we will analyze and explore the operating mechanism of Eigenlayer from a macro to micro security perspective, while innovating the Defi ecosystem, it will bring new security challenges and tests.

Top -level design and macro security

RestAKING is essentially a basic means to further solve specific problems by reusing the trust provided by the PROOF of Stake (POS) pledged fund pool. Eigenlayer, as the founder of RESTAKING technology, provides a newly free trafficking of Ethereum fund pool to a new market, provides a consensus market for sale. Eigenlayer claims that the current Ethereum ecology is suffering a macro security problem of trust division, and Eigenlayer can solve this problem well. Next, we will start from the design and motivation of Eigenlayer to understand what is trust division, and how Eigenlayer solves trust division.

- Who is the service target of the consensus market? Who is the two parties involved in two -way freedom?

Eigenlayer sells the trust provided by Ethereum Ethereum's pledged fund pool, so the consensus seller is the Validator of Ethereum verification node. The buyer, the active verification service, ACTIVELY VALIDATED Services (AVSS). In simple terms, it can be understood as one of the services that need to build a distributed trust network. AVS is a buyer, and their demand is to buy distributed trust.

the Runes protocol tokens are just getting started with their price discovery! 💰🚀 The crypto market is always full of surprises. #RunesProtocol #PriceDiscovery

When the BRC20 token economy hits $ 2.8 billion, but the Runes protocol tokens are just getting started with their price discovery! 💰🚀 #RunesProtocol #PriceDiscovery