It’s the beginning of a new era for the BNB Chain ecosystem, as the BNB Greenfield testnet, called “Congo,” has gone live. The decentralized smart storage network gives users control over their data and aims to provide the Web3 equivalent to Web2 cloud storage.

🚀1/ 🎉 Exciting news! BNB Greenfield Testnet is LIVE! 🧵t.co/O5BkyIKbHY

— BNB Chain (@BNBCHAIN) April 11, 2023

A BNB Chain Blog post confirms that the new Greenfield network will be powered by the BNB coin, giving it new utility.

“The BNB token's use will extend to large-scale data storage and trading, which will enhance its value over time,” according to the post.

As BSC News reported previously, BNB Chain is effectively inventing a new blockchain that will allow users and Decentralized Applications (dApps) the ability to store, access, and manage their data with personal keys and private accessibility.

The blog post states, "A native relayer links BSC and Greenfield, enabling BSC Dapps to integrate with Greenfield using a simple SDK and minimal development. Upon Greenfield mainnet launch, thousands of Dapp data sets will be available, fostering rapid ecosystem growth and easing data-related innovation compared to other chains."

According to BNB Chain, the defining characteristics of Greenfield are:

Data ownership

EVM compatibility by integration with BSC

High performance rich API/SDK.

BNB Chain has put out a call for testnet developers and announced that grants will soon be open for Greenfield grants.

Greenfield’s mainnet launch is scheduled for the third quarter of 2023.

What is BNB Chain:

Previously known as the Binance Smart Chain (BSC), BNB Chain is a community-driven, decentralized, and censorship-resistant blockchain that is powered by Binance. It consists of BNB Beacon Chain and BNB Smart Chain, EVM compatible and facilitating a multi-chain ecosystem. Through the concept of MetaFI, BNB Chain aims to build the infrastructure to power the world’s parallel virtual ecosystem.

BNB Greenfield Goes Live With ‘Congo’ Testnet](https://cryptonews.net/news/blokcheyn/20796820/))

New Utility for BNB Coin It’s the beginning of a new era for the BNB Chain ecosystem, as the BNB Greenfield testnet, called “Congo,” has gone live. The decentralized smart storage network

The number of UAW engaged in games on Polygon increased by 53% compared to February, placing Polygon well ahead of Hive and BNB Chain, which ranked third and fourth, respectively, with 84,000 and 80,000 UAW. However, Wax remains the leader with 314,000 UAW.

Polygon has become increasingly popular as a scalability solution for Ethereum, as it aims to solve problems related to high gas fees and slow transaction times on the Ethereum network.

Using Polygon, developers can build and deploy decentralized applications (dApps) that offer faster and cheaper transactions, making them more accessible to users.

The rise of the blockchain game has been one of the most significant trends in the blockchain industry in recent years, as it provides a new and exciting way for users to interact with decentralized applications.

The ability to earn cryptocurrencies by playing has also made blockchain gaming more attractive to a wider audience.

Good increase in the number of UAWs engaging in gaming on Polygon testifies to the platform’s effectiveness as a scaling solution for Ethereum. By offering faster and cheaper transactions, developers can create more engaging and interactive games that attract more users.

In addition, Polygon has a strong community of developers who are constantly building new and innovative dApps on the platform. With the support of this community, Polygon is well positioned to continue its growth and become the platform of choice for blockchain games.

Chainlink collaborates on a unique charity art exhibition at NFT.NYC to capture the billion-dollar NFT market

Chainlink, the decentralized oracle network, has partnered with NFT.NYC to host a unique charity art exhibition to conquer this billion-dollar market.

The event will showcase the power of Chainlink’s decentralized oracle network in creating secure and tamper-proof NFTs that cannot be duplicated or counterfeited. The exhibition will feature artwork by some of the world’s most renowned artists, including Trevor Jones, Mad Dog Jones and Osinachi.

All proceeds from the sale of these artworks will be donated to various charitable causes, making this exhibition a noble cause for art lovers and collectors.

The event, to be held on 20 May 2023, will also feature talks by industry experts, including Chainlink founder Sergey Nazarov and NFT.NYC founder Aaron Dupree. The exhibition will offer attendees a unique opportunity to network and learn more about blockchain and NFTs.

Chainlink has been at the forefront of providing secure and reliable decentralized oracle services to the blockchain industry. Its oracle network ensures that smart contracts are executed accurately and efficiently, enabling the creation of tamper-proof NFTs.

Chainlink’s collaboration with NFT.NYC testifies to the potential of decentralized technologies in transforming traditional industries.

The art industry has traditionally been exclusive and dominated by a few wealthy individuals and institutions.

However, the emergence of NFTs has democratized the industry, enabling anyone to own and exchange digital art.

The charity art exhibition organized by Chainlink and NFT.NYC aims to make art accessible to a wider audience and give back to society.

The event is expected to attract art collectors, investors and enthusiasts from around the world. It will be an opportunity to view some of the most unique and rare digital artworks while contributing to a good cause.

Thanks to Chainlink’s secure and reliable oracular network, attendees can be assured that the artworks on display are authentic and cannot be duplicated or counterfeited.

Crypto analysis of MATIC, Elrond and Chainlink](https://cryptonews.net/news/analytics/20796616/))

We continue our analysis of the crypto world with regard to news and prices, today in particular we will analyze three very interesting projects, Polygon (MATIC), Chainlink (LINK) and

As Ethereum finalizes its transition to a proof-of-stake (PoS) consensus mechanism with the upcoming Shapella fork, approximately $34 billion of locked, staked Ethereum (ETH) will become available for withdrawal by validators. The imminent unlock has led to speculation about the potential impact on the cryptocurrency market, especially considering that much of the locked volume is already liquid due to staking liquidity providers.

Staking liquidity providers have been issuing liquid tokens in exchange for locking Ethereum in contracts, allowing investors to access and trade their staked assets without needing to wait for the unlocking event. This has created a situation where a significant portion of the locked, staked Ethereum is already circulating on the market, potentially reducing the immediate impact of the $34 billion unlock.

Ethereum is about to finalize its transition to proof of stake with the upcoming #Shapella fork. This will enable $ETH staked to be withdrawn by validators, allowing $34B of currently locked staked ETH to enter the market. How will the price react? pic.twitter.com/IyOm38kAdE

— IntoTheBlock (@intotheblock) April 10, 2023

However, it is still uncertain how the market will react to the unlocking event, as some investors may choose to sell their newly accessible Ethereum holdings, potentially putting downward pressure on the price. Others may decide to hold onto their Ethereum, anticipating further price appreciation as the network continues to evolve and improve with the transition to PoS.

The shift to a PoS consensus mechanism is expected to make Ethereum more energy-efficient, scalable and secure. This could result in increased demand for the cryptocurrency, as more developers and users are drawn to its improved capabilities. In the long term, the successful implementation of PoS could bolster Ethereum's position as the leading smart contract platform, driving further adoption and demand for the digital asset.

As more Ethereum is staked and withdrawn from contracts, the supply-demand dynamics could shift, potentially leading to an increase in the value of the asset.

$34 Billion Ethereum (ETH) to Enter Market in 24 Hours](https://cryptonews.net/news/ethereum/20796505/))

As Ethereum finalizes its transition to a proof-of-stake (PoS) consensus mechanism with the upcoming Shapella fork, approximately $34 billion of locked, staked Ethereum (ETH) will become

Russian politicians say they will debate a long-awaited crypto regulation bill before the end of the current parliamentary session.

The move is a suggestion that some parts of the crypto sector may finally move out of the regulatory grey area.

The media outlet News.ru reported that the State Duma (the Russian parliament) is set to hold a first reading for a “bill on the legalization of cryptocurrencies” in the (current) spring session.

The current session concludes at the end of July.

Anatoly Aksakov, the Chair of the State Duma Committee on the Financial Markets, was quoted as stating:

“I think that in the spring session, we will adopt a law, for sure at least in the first reading. It will focus on the legalization of the use of cryptocurrencies for [overseas] payments and [overseas] financial transactions. We have agreed with the Central Bank and the government that this must be done.”

The nation’s Central Bank wants to ban all forms of crypto-related activity.

It has indicated, however, that it may be prepared to allow Russian firms to do international trade in crypto.

Doing so would allow trading firms to evade Western sanctions placed on Russian companies following the outbreak of war with Ukraine last year.

But it will only countenance the move if traders swap their coins for fiat on trading platforms.

Will Russian Crypto Law Held Create a ‘State-run Crypto Exchange?’

Some politicians have claimed that Moscow should create a state-run crypto exchange for the purpose of aiding importers and exporters.

Aksakov opined that the “legalization” of the use of crypto in trade deals would “allow the country to pay for imported goods and carry out other operations” using tokens.

Aksakov added:

“I believe it is better to legalize such infrastructure [by launching a state-run crypto exchange]. But the Central Bank has a different opinion on this matter. The position of the Ministry of Finance is much closer to mine. This is a matter for discussion.”

Crypto trading and mining are currently neither legal nor illegal in Russia.

Instead, they have no legal status, and are not subject to taxation.

Last week, the Central Bank revealed that Russian households are now spending more on crypto than they do on gold and other precious metals.

Russian MPs to Debate Crypto Law in Coming Weeks – Is Regulation Finally on Its Way?](https://cryptonews.net/news/legal/20796625/))

Russian politicians say they will debate a long-awaited crypto regulation bill before the end of the current parliamentary session. The move is a suggestion that some parts of the crypto

After the flagship cryptocurrency, Bitcoin, surged above the $30,000 level earlier today, various experts have been sharing their takes, saying that BTC is on track to rise higher.

In the meantime, whales have begun shifting massive amounts of Bitcoin, and some are moving BTC to exchanges to lock in big profits.

Bitcoin still on course for $34,000, analyst believes

Crypto trader and analyst Ali Martinez has tweeted that his earlier prediction of Bitcoin's price rising continues to play out thanks to the bullish megaphone pattern. It forms on a chart after a series of higher highs and lower lows that, if a line is drawn along the upper and lower borders of the picture, looks like a megaphone.

Last week, Martinez stated that thanks to this pattern, Bitcoin is in for a bullish weekend. Now, the price has broken above the $30,000 level for the first time in the past 10 days. The analyst added in the tweet that "the bullish megaphone pattern continues to dictate $BTC's trajectory."

#Bitcoin remains on course for $34,000 as the bullish megaphone pattern continues to dictate $BTC's trajectory! 🐂 t.co/QzPPhpmtCh pic.twitter.com/00fK5etnpN

— Ali (@ali_charts) April 11, 2023

Bitcoin "34k -> 30k -> 42k"

In a recent exchange of comments with crypto influencer and founder of Gokhshtein Media David Gokhshtein, the co-founder of King Finance @OfficialTravlad shared his take on the next move of the Bitcoin price.

He said that he believes Bitcoin is going to keep rising toward $34,000, then he expects a bounce back to the $30,000 level. After this, according to his comment, he expects BTC to top the $42,000 mark.

I think 34k -> 30k -> 42k

— Travladd Crypto (@OfficialTravlad) April 11, 2023

Yesterday, Gokhshtein grabbed the community's attention as BTC was coming close to $30,000, but he said he was expecting a pullback before this price mark. His expectations did not come true.

At the time of this writing, digital gold is trading at $30,129, according to CoinMarketCap data, after a rise of 6.31% over the past 24 hours.

$655 million in Bitcoin moved

Santiment on-chain data vendor has spotted 11 enormous transactions, carrying roughly 2,000 BTC. In total, they moved 22,000 Bitcoins worth $655 million. These whales became active after Bitcoin surpasses the $30,000 mark.

The transactions were consecutive, occurring at short intervals. Another whale, or possibly one of the aforementioned ones — there is no any specification regarding that — sent 2,000 Bitcoins from their wallet to a Binance address, likely to sell this crypto and withdraw profits.

Besides, Bitcoin is currently a top four trending coin in crypto on social media platforms.

Bitcoin (BTC) on Course for $34,000, Thanks to This Bullish Pattern: Analyst](https://cryptonews.net/news/bitcoin/20795935/))

After the flagship cryptocurrency, Bitcoin, surged above the $30,000 level earlier today, various experts have been sharing their takes, saying that BTC is on track to rise higher.

Real Vision CEO Raoul Pal thinks Ethereum (ETH) competitor Solana (SOL) could mirror the top altcoin’s meteoric rise in price between 2018 and 2021.

In a blog post originally published for his clients in January, the former Goldman Sachs executive laid out his prediction for SOL’s long-term future.

According to Pal, SOL’s downtrend last year and its recent recovery are reminiscent of Ethereum’s performance over a three-year period.

Raoul Pal says that in 2018, Ethereum completed a five-wave downtrend before rising to its all-time high of $4,742 in November 2021.

“With SOL, I think we are seeing a repeat of ETH in 2018: a 5-wave fall of 95%. Here is ETH (it rose 46x from the low in 2018 to the high in [2021]!)”

Source: Raoul Pal/Real Vision

Looking at Solana, Pal believes that SOL has also completed a five-wave downtrend and now appears poised for a burst to the upside.

“Here is SOL…”

Source: Raoul Pal/Real Vision

SOL is trading at $21.15 at time of writing. The 11th-ranked crypto asset by market cap is up 4.70% in the past 24 hours.

Meanwhile, ETH is trading at null,933 at time of writing and is up nearly 4% in the past 24 hours.

Last month, the macro guru argued Ethereum’s technicals and fundamentals suggested it could massively outperform Bitcoin (BTC) in the coming cycle.

Pal believes that the leading smart contract platform’s total addressable market is much larger than Bitcoin’s.

“Ethereum is a broader basis architectural protocol of which we can build more stuff on top of. Bitcoin just doesn’t do that. It has a different use case. So it’s unlikely to be as big.

Is the internet worth more than gold? Yes, simple as that, and that’s basically the argument here.”

Former Goldman Executive Says Ethereum Competitor Primed To Repeat ETH’s Epic 2018 Rally](https://cryptonews.net/news/analytics/20795938/))

Real Vision CEO Raoul Pal thinks Ethereum (ETH) competitor Solana (SOL) could mirror the top altcoin’s meteoric rise in price between 2018 and 2021. In a blog post originally published

After the flagship cryptocurrency, Bitcoin, surged above the $30,000 level earlier today, various experts have been sharing their takes, saying that BTC is on track to rise higher.

In the meantime, whales have begun shifting massive amounts of Bitcoin, and some are moving BTC to exchanges to lock in big profits.

Bitcoin still on course for $34,000, analyst believes

Crypto trader and analyst Ali Martinez has tweeted that his earlier prediction of Bitcoin's price rising continues to play out thanks to the bullish megaphone pattern. It forms on a chart after a series of higher highs and lower lows that, if a line is drawn along the upper and lower borders of the picture, looks like a megaphone.

Last week, Martinez stated that thanks to this pattern, Bitcoin is in for a bullish weekend. Now, the price has broken above the $30,000 level for the first time in the past 10 days. The analyst added in the tweet that "the bullish megaphone pattern continues to dictate $BTC's trajectory."

#Bitcoin remains on course for $34,000 as the bullish megaphone pattern continues to dictate $BTC's trajectory! 🐂 t.co/QzPPhpmtCh pic.twitter.com/00fK5etnpN

— Ali (@ali_charts) April 11, 2023

Bitcoin "34k -> 30k -> 42k"

In a recent exchange of comments with crypto influencer and founder of Gokhshtein Media David Gokhshtein, the co-founder of King Finance @OfficialTravlad shared his take on the next move of the Bitcoin price.

He said that he believes Bitcoin is going to keep rising toward $34,000, then he expects a bounce back to the $30,000 level. After this, according to his comment, he expects BTC to top the $42,000 mark.

I think 34k -> 30k -> 42k

— Travladd Crypto (@OfficialTravlad) April 11, 2023

Yesterday, Gokhshtein grabbed the community's attention as BTC was coming close to $30,000, but he said he was expecting a pullback before this price mark. His expectations did not come true.

At the time of this writing, digital gold is trading at $30,129, according to CoinMarketCap data, after a rise of 6.31% over the past 24 hours.

$655 million in Bitcoin moved

Santiment on-chain data vendor has spotted 11 enormous transactions, carrying roughly 2,000 BTC. In total, they moved 22,000 Bitcoins worth $655 million. These whales became active after Bitcoin surpasses the $30,000 mark.

The transactions were consecutive, occurring at short intervals. Another whale, or possibly one of the aforementioned ones — there is no any specification regarding that — sent 2,000 Bitcoins from their wallet to a Binance address, likely to sell this crypto and withdraw profits.

Besides, Bitcoin is currently a top four trending coin in crypto on social media platforms.

Bitcoin (BTC) on Course for $34,000, Thanks to This Bullish Pattern: Analyst](https://cryptonews.net/news/bitcoin/20795935/))

After the flagship cryptocurrency, Bitcoin, surged above the $30,000 level earlier today, various experts have been sharing their takes, saying that BTC is on track to rise higher.

Ethereum's highly anticipated Shanghai upgrade, also called the Shanghai-Capella hard fork, is set to occur Wednesday, after which users will have access to the $31 billion worth of ether (ETH) staked in the blockchain since December 2020.

The upgrade has been widely hailed as long-term bullish for Ethereum's native token. Still, bitcoin (BTC), not ether, is outperforming the broader crypto market and becoming more dominant as the upgrade approaches.

Bitcoin's dominance rate, which measures the largest cryptocurrency's share of total market valuation, rose to 48.5% early Tuesday, the highest since July 2021, according to data tracked by charting platform TradingView. The metric has risen by 15% this year.

Ether's dominance rate remains stagnant between 19% and 20%. That compares with a rise to 21% from 14% in the weeks before September's pivotal upgrade known as the Merge. That technological overhaul replaced Ethereum's at-the-time energy-intensive proof-of-work mechanism of verifying transactions with a proof-of-stake system and set the stage for Shanghai. Staking involves depositing coins in the blockchain to boost the network's security and verify transactions in return for rewards.

Investor caution in pricing ether ahead of Shanghai stems from several factors, including concerns tokens unlocked after the upgrade will flood the market, and regulatory issues.

"The Shanghai upgrade will unlock over 18 million ether staked since late 2020. The market is worried that the unlocking may bring about a sell-off, causing uncertainty in the market," Griffin Ardern, a volatility trader at crypto asset management firm Blofin, told CoinDesk.

While the upgrade will unlock over 18 million ETH, only partial withdrawals of 1.1 million ETH – the coins earned as staking rewards – will be withdrawable immediately.

Analysts have recently said that the partial withdrawals will take several days to process and the resulting selling pressure is unlikely to be significant.

"If all partial withdrawals are attempted just after the Shapella fork (which seems highly improbable), it would take around four and a half days for these ETH profits to enter the market," Lucas Outumuro, head of research at IntoTheBlock, said in a note published Friday.

According to Outumuro, full withdrawals representing most of the ETH staked will take longer.

"It would take approximately 100 days for one-third of validators to exit if they all attempt to exit simultaneously, translating into $80-$100M worth of ETH being withdrawn per day. This would make up about 1% of ETH’s daily trading volume, though it is unlikely that all withdrawals will be sold," Outumuro noted.

The market, however, is not convinced, as evident from ether's underperformance relative to bitcoin and ether put options, or bearish bets, drawing higher prices than call options.

Regulatory concerns are probably also weighing on investors. In February, the U.S. Securities and Exchange Commission (SEC) alleged that Ethereum staking services offered by centralized exchanges amount to selling unregistered securities in the U.S.

"ETH faces relatively higher regulatory risks. The SEC has repeatedly stated that ETH is a security rather than a commodity, which differs from the CFTC's opinion and means additional risk, so investors understandably prefer BTC," Ardern said. The CFTC is the agency governing the futures market.

Lastly, recent banking sector instability in the U.S. and the resulting sharp repricing of interest-rate expectations lower worldwide has benefited bitcoin. The cryptocurrency has evolved as a macro asset in the past three years and has a history of drawing haven bids during banking crises.

"BTC got the store-of-value narrative back after multiple U.S. banks failed in mid-March. Since then, BTC's dominance rate has been rising," Dubai-based crypto analyst and trader Reetika Malik said. Dominance rate is now at a "multiyear resistance" that has capped the upside in the past, meaning ether and other coins could soon outshine bitcoin, per Malik.

"By being concerned, the market is actually 'pricing in' already any selling pressure that we are likely to get from the Shanghai hard fork and the upgrade could actually become a 'buy the news' event," Malik said. "BTC dominance chart is at a multiyear resistance as well as we speak. All the stars are aligning for a rotation into ETH."

Bitcoin, Not Ether, Builds Crypto Market Dominance Ahead of Ethereum's Shanghai Upgrade](https://cryptonews.net/news/analytics/20796091/))

Ethereum's highly anticipated Shanghai upgrade, also called the Shanghai-Capella hard fork, is set to occur Wednesday, after which users will have access to the $31 billion worth of

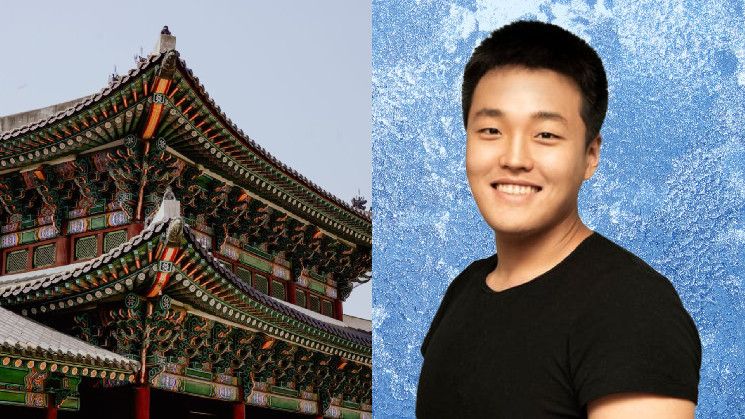

Seoul Southern District Prosecutors’ Office is freezing 7.1 billion Korean won (US$5.36 million) worth of assets belonging to Terraform Labs chief executive officer (CEO) Kwon Do-hyung, more popularly known as Do Kwon, a spokesperson for the prosecutors’ office told Forkast Tuesday in a text message.

See related article: Montenegro to hold Terra-Luna fugitive Do Kwon for 30 days, says Yonhap News

Fast facts

A Seoul court is reviewing Kwon’s domestic and overseas-based assets for restitution, the Seoul prosecutors’ office spokesperson said.

The Seoul Southern District Prosecutors’ Office previously confirmed with Forkast Friday that Kwon had “zero” identifiable assets to be confiscated in South Korea. The spokesperson declined to comment on how much Kwon’s assets in South Korea accounted for in the 7.1 billion won.

When approved by court, South Korea is expected to prevent Kwon from moving or selling the identified assets. The amount will be confiscated after a final guilty verdict from the court.

The assets include Kwon’s deposits in overseas accounts including one based in Switzerland, where Seoul prosecutors are requesting judicial cooperation, according to a report from South Korean news agency News1 that the prosecutors’ office confirmed with Forkast.

Legal procedures to obtain Kwon’s laptops, hard disks and other Terraform-related equipment are also underway, according to the News1 report verified by the Prosecutors’ Office.

South Korea and the U.S. have sent the Montenegro authorities requests to extradite Kwon on charges including fraud and securities law violations. Kwon and Terraform Labs have repeatedly said the charges are baseless and politically motivated.

Kwon is currently detained in Montenegro for allegedly traveling with forged travel documents, along with Terraform’s chief financial officer Han Chang-joon. They were arrested in a local airport on March 23.

South Korean prosecutors to freeze US$5.36 million of Do Kwon’s assets, some in Switzerland](https://cryptonews.net/news/legal/20796238/))

Seoul Southern District Prosecutors’ Office is freezing 7.1 billion Korean won (US million) worth of assets belonging to Terraform Labs chief executive officer (CEO) Kwon Do-hyung,