What does the drophunting process look like?

1. Analyze and choose a project;

2. Do tasks, checking the functionality of the project:

Mainly these are bridges/swaps in the system.

Swaps are when we exchange one crypto for another,

Bridges are when we transfer crypto from one network to another

+ additional activities: (link Twitter/mint NFT/enter Discord)

3. Do this for a long time;

4. Wait for a snapshot (when the project counts all transactions);

5. Wait for the token and distribution to wallets;

✅ Pros:

+ big rewards + opportunity to level up in crypto/technology

+ possibility of scaling using a farm

+ life change money (money that will change your life)

+ good risk/reward ratio

Simply put: you can earn easy money💰

❌ Cons

-nobody knows when there will be a drop and whether there will be one at all

Simply put: this is a venture story, it is possible to stupidly spend money on commissions

Recommendations

The direction is gaining a trend, especially after the listing of Arbitrum.

When a large number became millionaires, and someone even dollar 🍋

The entry threshold is low and sometimes it is free.

A fatal mistake would be not to take a piece of the pie

The most important task of the regulator is control and supervision. SEC controls literally everything that is somehow connected with securities. The main areas of activity: the agency establishes the rules for registering securities and the rules related to the activities of stock exchanges; The agency conducts an audit, checks and even investigations against suspicious participants. For example, if information is received about fraudulent manipulations in the market, trade using insider information, and so on; The agency requests numerous reports and documents, achieves the complete transparency of actions by all financiers.

Who does the commission control? SEC monitors the following market participants: everyone who produces securities - shares, bonds and various derivatives; Primary financial market: all stock and commodity exchanges (for example, NASDAQ, CBOE or NYSE); all brokers; All major traders; All private investors who have bought more than 5 % of the company's shares from any US exchange; Investment banks, holdings, ETF funds, hedge funds, etc. Trade groups, namely US OTCs (for example, OTC Markets Group).

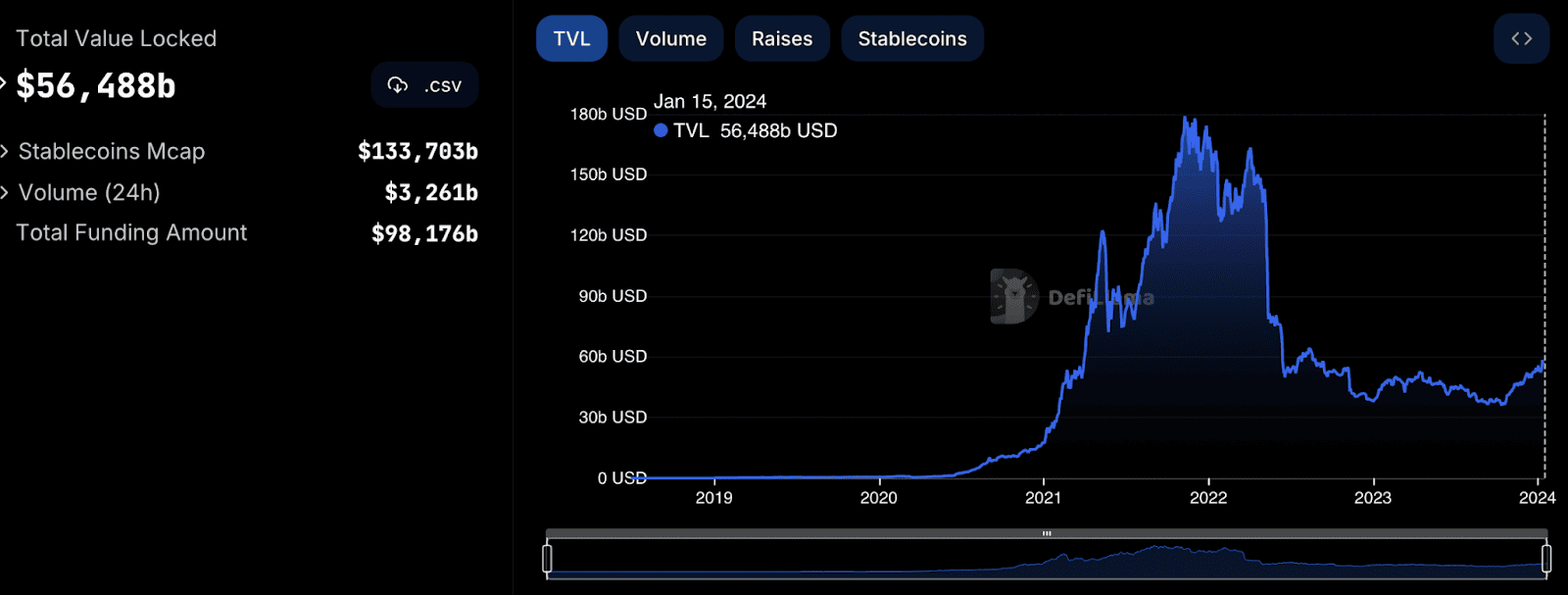

What is DeFi?

DeFi is an ecosystem of decentralized financial services and applications based on public blockchains.

DeFi tools expand the use of distributed ledgers from standard transactions to more complex and complex financial transactions. For example, lending and borrowing.

How does DeFi work?

Decentralized applications are open and accessible - they do not require clients to provide personal information or create accounts.

DeFi solutions can exist on various blockchains, with users collaborating within a peer-to-peer (P2P) network. Smart contracts ensure that the terms of transactions are properly fulfilled.

All work of decentralized finance is carried out in accordance with programmed rules without the participation of a third party. Information about transactions is recorded on the blockchain, where it is impossible to change or falsify the data.

What are the features of Arbitrum and what are Optimistic Rollups?

The low transaction speed and high fees in Ethereum led to the emergence of several projects that began developing solutions on top of the main network in order to improve its performance.

The Arbitrum network uses Optimistic Rollups technology for these purposes. Transaction processing takes place on the second layer network, while the main Ethereum network is responsible for the security layer. During processing on the L2 network, many transactions are combined into a compact block, which is included by validators in the main Ethereum network.

The term “optimistic” is a reference to the principle that any “optimistic” transaction is considered genuine until proven otherwise. This concept was developed for a competing L2 network called Optimism. However, Arbitrum developers have improved the technology by introducing multi-stage fraud protection, which uses significantly less gas than single-stage protection in Optimism.

To pay transaction fees on the Arbitrum network, ETH is used, just like Ethereum. Transfers on the Arbitrum network are on average 90-95% cheaper than Ethereum, and there remains great potential for further reductions in fees.

In March 2023, the project conducted an airdrop of the ARB governance token. Its holders can make decisions regarding the Arbitrum One and Nova networks, including changes to the code. The L2 solution team is committed to bringing the product under the control of a DAO.

Solana has a large community - over 84 thousand people on Telegram, and more than 250 projects have been launched on its blockchain. According to representatives of the Solana Foundation, the current throughput of the blockchain is 60 thousand transactions per second, and in the future it could be up to 710 thousand transactions per second. This high transaction processing speed is based on the Proof of History (PoH) solution algorithm and Gulfstream and Turbine data transfer protocols.

How does the Solana blockchain work?

You can skip advertising through

Unlike Polkadot, Ethereum and others, Solana is a layer-one blockchain that does not have sidechains or parachains. Representatives of Solana claim that their blockchain is based on the PoS (Proof of Stake) consensus algorithm, but not everyone in the community agrees with this. It is believed that Solana is based on the dPoS (Delegated Proof of Stake) algorithm.

The high speed of transaction processing in it is based on the PoH solution, which allows time synchronization between nodes much faster, thanks to the creation of decentralized clocks. Within the framework of the validator nodes operating schedule (Leader Schedule) and the Turbine and Gulfstream data transfer protocols, interaction between nodes is synchronized. This solves the problem of orphan blocks, traditional for other chains, including Ethereum, and reduces the block mining time to 0.4 seconds.

The faster synchronization between nodes on the Solana blockchain makes it fast enough to compete with complex centralized systems. Other innovations in this ecosystem are archivers that provide distributed data storage and optimization of transaction recording through Cloudbreak. Solana blockchain nodes are rewarded for processing transactions in the SOL utility token and, unlike other PoS chains, it has no restrictions in the form of a minimum number of coins required to create a node.

Long before the bitcoin and the passage of crypto -inns became digital currency -on the Internet, on one of the forums, an idea appeared. Before some coin attracted the attention of thousands, and maybe millions of investors, ordinary lovers of new products and those who want to see the next freebie-known as Satoshi Nakamoto proposed one interesting idea that was successfully realized in the near future.

In October 2008, an article was published by a certain Satoshi Nakamoto called “A Peer-to-Peer Electronic Cash System”. Which in translation means: decentralized or equal electronic monetary system.

Satoshi became the father of cryptocurrencies or blockchain. He had repeatedly attempts to create similar monetary structures, but all of them were centralized - the analogues of the already existing banking all.

The first version of the bitcoin code was released in January 2009 -the first block was created in the Bitcoin blockchain, which gave rise to the first Bitcoin mining. This transaction was carried out between Nakamoto himself and one of the developers named Hal Finnie.

Initially, Bitcoin did not have an exchange rate and equivolence in fiat currency, but in October 2009, one US dollar was equal to 1.309 bitcoin. The exchange rate was equal to the cost of electricity to create the first bitcoin through mining.