Worldcoin (WLD) is down more than 13% to $ 1.91 after Sam Altman stepped down as CEO of OpenAI. Questions have been raised about Altman's role at WorldCoin, known for its corneal scanning technology, while the project has faced criticism for its token distribution strategy and resistance from countries like Kenya.

As the largest stablecoin issuer, Tether is planning to invest $500 million over the next six months to become one of the largest bitcoin miners in the world. With mining farms in Uruguay, Paraguay and El Salvador, they aim to increase their share of the total Bitcoin hashrate to 1%.

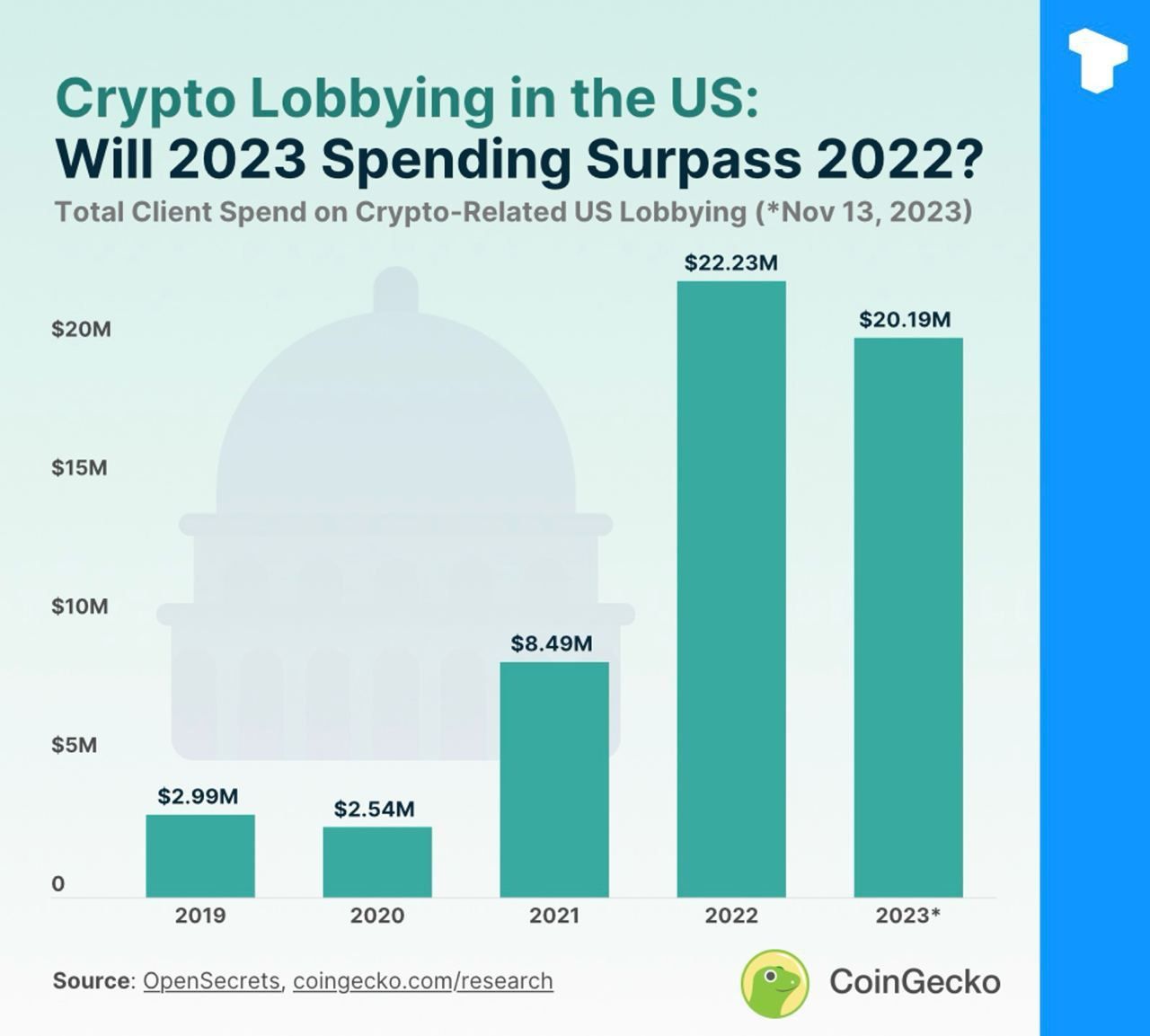

From 2019 to Q3 2023, lobbying spending for the cryptocurrency industry in the United States reached $56.44 million.

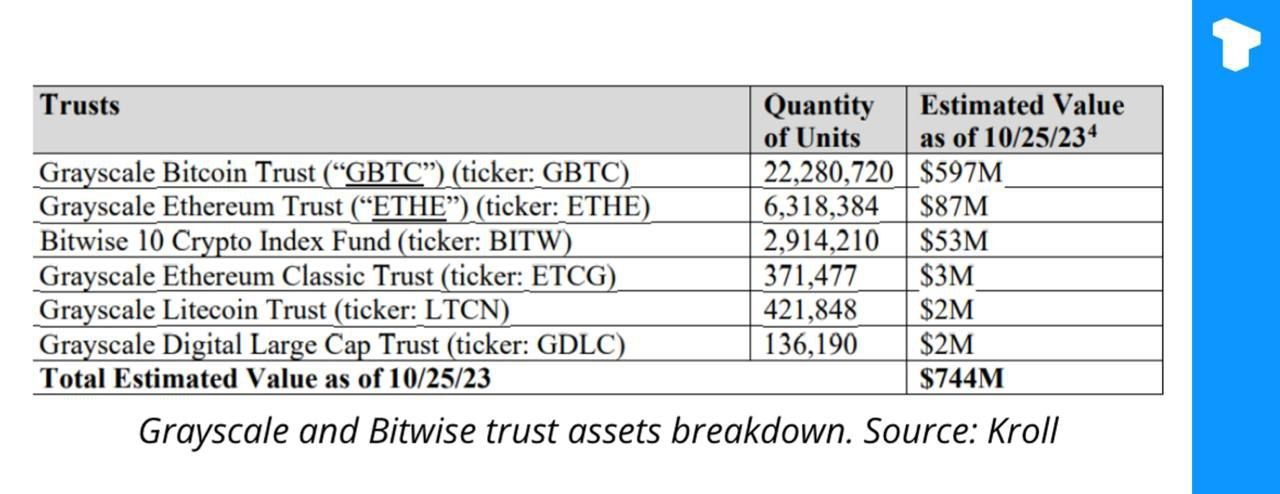

FTX is seeking to sell trust assets, including those in the Grayscale and Bitwise funds, worth approximately $744 million, to prepare for distribution to creditors and a quick liquidation. This sale is expected to minimize the risks and maximize the benefits of the creditors.

Tim Buckley, CEO of Vanguard, confirmed that the company will not pursue a spot bitcoin ETF. Vanguard, the world's second largest asset management firm behind BlackRock, believes that cryptocurrencies have no intrinsic value, do not generate cash flow and are highly volatile, making them unsuitable for its investment strategy.

According to analysts, contrary to expectations for spot ETFs, Bitcoin's recent price increase has been largely driven by macroeconomic factors such as Treasury estimates and a cautious FOMC. Future events can affect volatility, and a major drop below $32k is unlikely without regulatory intervention.

Due to the removal of restrictions on NFT-related keywords on the Alibaba Marketplace in the search section, restrictions in China seem to have been eased, and Topnod NFT collections minted on Alibaba's Ant blockchain have been re-listed.

The crypto market has seen an increase in delistings, this year more than 3,445 tokens and trading currency pairs have been removed from the market or disabled for a long time. This figure is 15% more than in 2022 and is twice the figure of the previous year.

CFTC Commissioner Samer Mersinger believes that investing in digital currencies is no longer a passing interest and the reason for this is the increasing institutional and institutional interest in this sector. He noted that the market is very ready for cryptocurrency-related products